Importance of Correct Sales and Cost Amounts to Determine Break-Even Point of Business

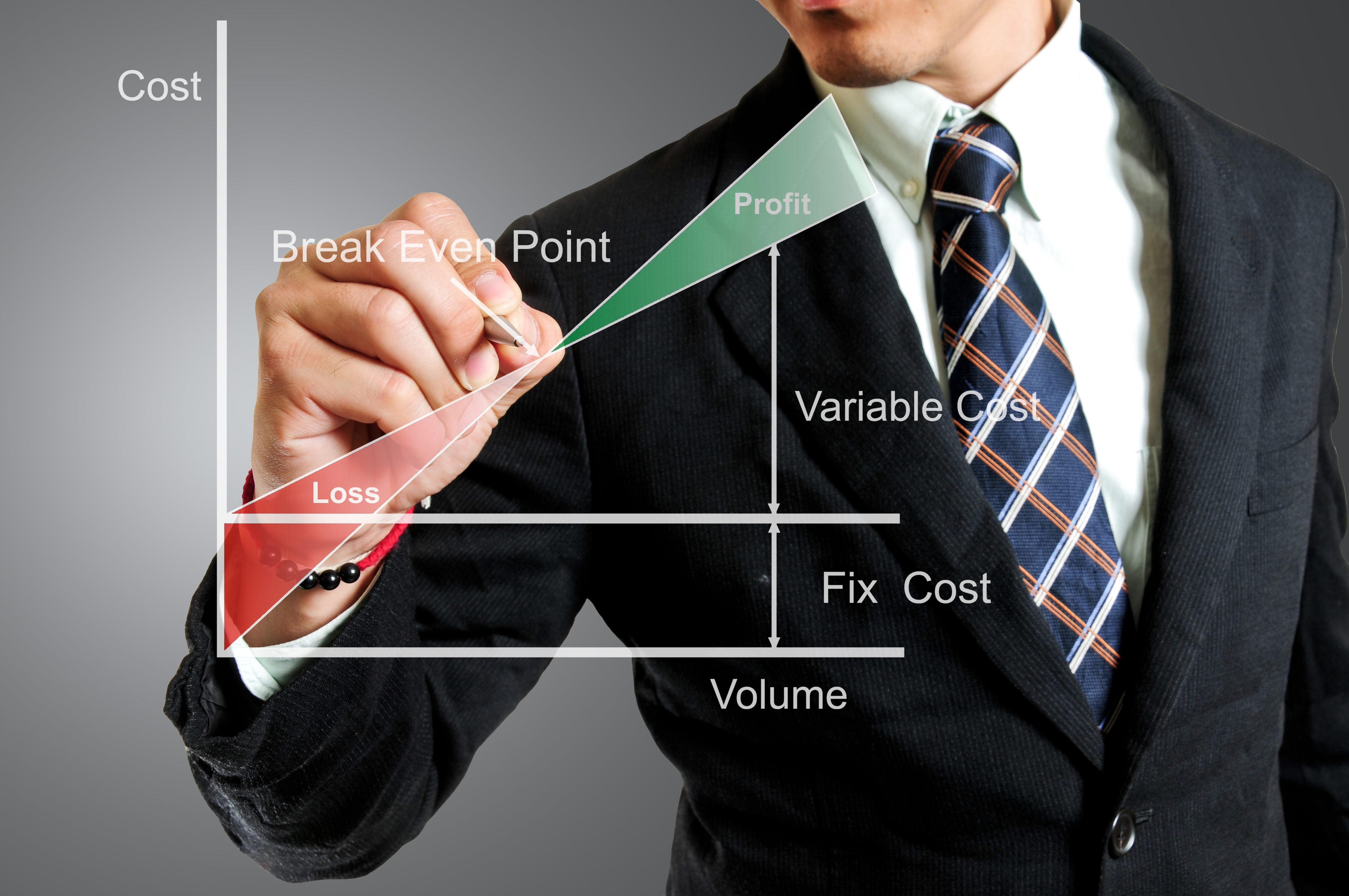

One of the greatest challenges every business owner faces is how to determine the company’s break-even point. This is especially true for businesses that have just been established or just began operating in the first few months. So what exactly does break-even point mean from a business point of view? In simple words, break-even point refers to the number of unit sales/sales amount in which total costs composed of variable/fixed cost is recovered and profit equals zero. However, business owners must remember that break-even level or break-even point can only be possible if the product is sold at more than its cost of purchase from the supplier or more than its manufacturing cost if it is manufactured. This is better expressed in the expression:

Sales – Cost of Sales = Gross Profit or Gross Margin

A very important point to remember is the sales tax. In computing the sales for break even or profit planning and analysis, you must make sure the sales figure is net of sales tax. This is because if you use the sales amount which include the sales tax, you are overstating the gross margin by the sales tax amount included. This will result in an unrealistic break-even point figure which actually results in a net loss.

If the goods sold are purchased including tax and you make tax credit for the purchase tax, you have to also exclude the tax paid in purchasing the product to ensure proper matching of revenues and costs. Take for instance the following scenario:

- You sell Product A for 55.00 SGD subjected to 7% GST and you purchased this unit for 30.00 SGD without tax. To determine the gross profit or gross margin, the computation would be:

Sales 51.40 (55.00 SGD divide by 1.07)

Cost 30.00

Gross Profit/Margin 21.40

- You sell Product A for 55.00 SGD subject to 7% GST and you purchased this unit for 30.00 SGD also including GST. To determine the gross profit or gross margin, the computation would be:

Sales 51.40 (55.00 SGD divide by 1.07)

Cost 28.04 (30.00 SGD divide by 1.07)

Gross Profit/Margin 23.36

If you compute for the gross profit margin using the sales price including GST and cost price including GST, the result is different from that 23.36 SGD GP rate per unit per number 2 above. The computation result to a gross profit of 25.00 SGD, which is overstated compared to 23.36 SGD. Overstated gross profit, for sure will lead to understatement of break-even point and mislead the management in making important financial decisions because the business actually incur loss materially if there is substantial fixed and variable costs to be recovered.

Sales 55.00

Cost 30.00

Gross Profit 25.00

Based on the above scenario, you are able to realize the importance of using the correct sales and cost figures in order for you to proceed to the next step of computing the break-even point sales in terms of quantity or units and sales in amount. This process is taken up in the next topic to make break-even computation easier for you.