MYOB Payables Reports

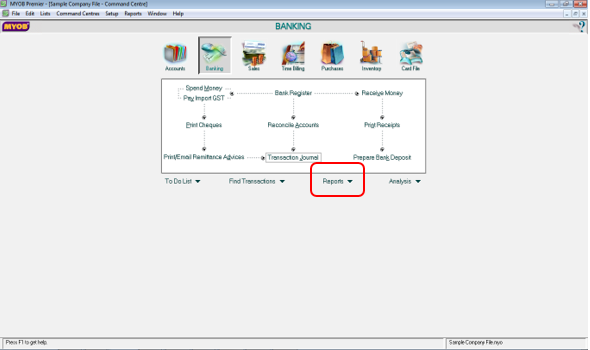

We have previously discussed about end-of-year procedures which includes checking the payables account and making sure it reconciles with the amounts reported to in the Balance Sheet report. One of the effective ways to make this objective easy to achieve is to be familiar with the built-in reports in MYOB for Purchases. Like the previous article, you gain access to these reports by going to the Reports window per the screenshot below:

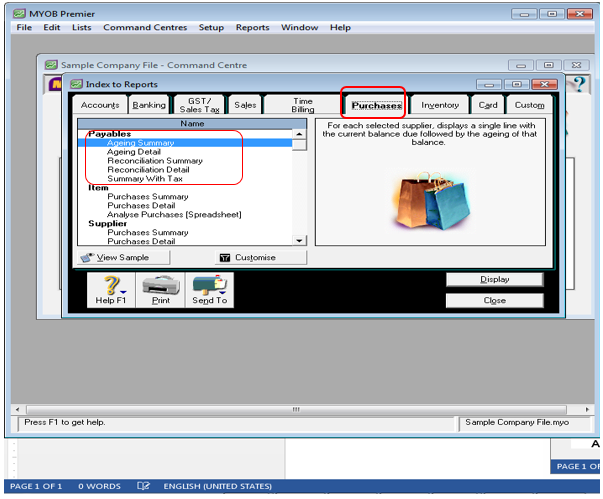

In the Reports window, go to the Purchases tab as per the screenshot below:

The MYOB Payables reports are as follows:

- Ageing Summary

- Ageing Detail

- Reconciliation Summary

- Reconciliation Detail

- Summary With Tax

Ageing Summary

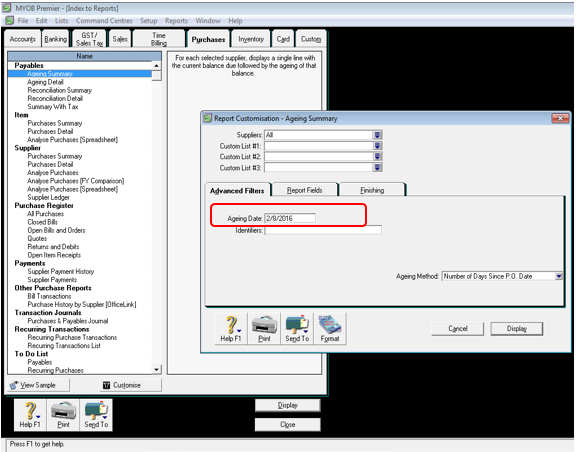

The Payables Ageing Summary shows all the vendor aged payables per total amount in categories of 0-30, 31 to 60 days, 61 to 90 days and more than 90 days ageing brackets. If you wish to indicate a specific date for which you want the ageing report, fill in the date on the Ageing Date field as per screenshot below:

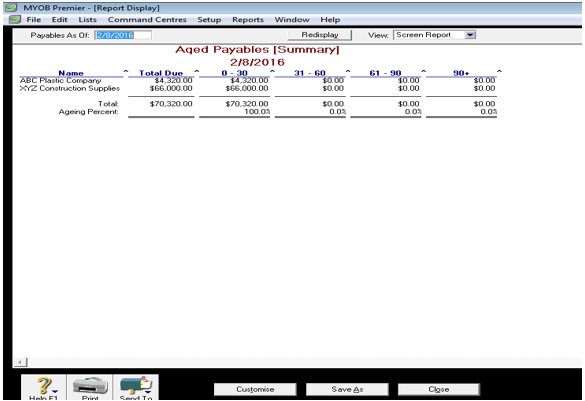

As this is a summary type of ageing report, you won’t see the details of invoices due and invoice dates. If you wish to see the details of the invoices due per vendors as well as the invoice dates, you need to use the Payables Ageing Detail. A screenshot of the Ageing Summary is attached below:

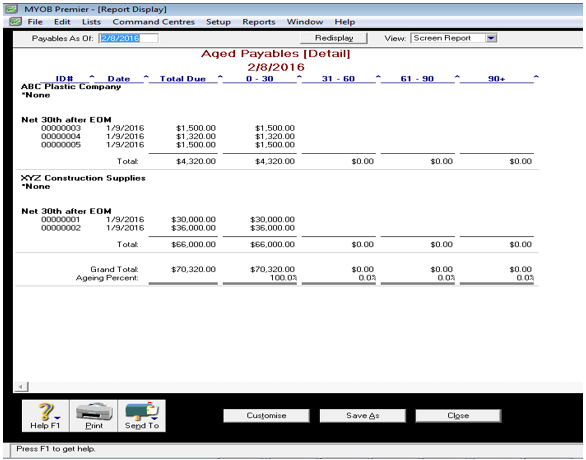

Ageing Detail

This ageing report shows the details of the invoices and the dates of each invoice based on 0-30 days, 31 to 60 days, 61 to 90 days and over 90 days due as well as payment terms and the due date if you have indicated this information when you have created the supplier or vendor card. You can also generate report as of a date basis by indicating the date on ageing report you wish to run in the Ageing Date field as shown in the previous screenshot. A sample Payables Ageing Detail is attached per screenshot below:

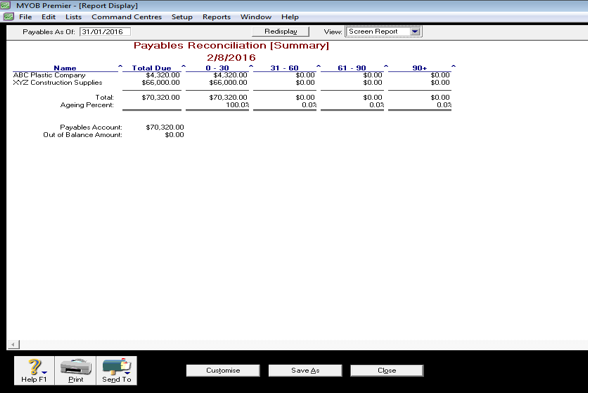

Reconciliation Summary

The Payables Reconciliation Summary shows the Out-of-Balance or variance in the Payables report. The attached screenshot below shows a zero out-of-balance amount.

In case you run into an Out of Balance of any amount, this could be caused by a bill entered after the invoice payment date and it so happen you are not able to notice when the warning is prompted. You can also run the Company Data Auditor which is in the troubleshoot for this by clicking on the Accounts command centre. In the Accounts command centre, click on the Company Data Auditor. You can also review if you have setup the correct beginning balance as error in amount setup could also result to out of balance amount in the Payables account reconciliation.

Payables Reconciliation (Detail)

The Payables Reconciliation Detail is almost the same as Reconciiation Summary only that it is more detailed showing the ageing report with details of invoices and invoice dates and the Out of Balance amount.

Summary With Tax

The Payables Summary With Tax shows the total payables per vendor or supplier and showing the outstanding tax due in the next column. This is also a useful tool to know if you have applied the correct tax codes when entering the vendor bills in MYOB especially if the vendor only have one tax codes applicable to all transactions.